How to Save Taxes on Education - Education Related Tax Benefits for Texas Residents

Since everybody's talking about the tax reform at the moment and no one really knows whether and what's going to happen if the tax reform goes through: here are some ways you can currently save on education as a Texas resident (which you may want to take advantage of as they could possibly be gone soon).

In Texas, as in many other parts of America, people are discovering that tax breaks related to education are readily available. While this is not secret knowledge, many Texans are not aware of the options for tax savings they are eligible to receive because of their educational pursuits. It is wise to take the time to learn more about ways the State of Texas can help its citizens receive reductions in their taxes.

The Texas College Savings Plan

One way for Texas residents to benefit from a tax break while saving for higher education is to take part in the Texas College Savings Plan. The plan is open to all residents of the State of Texas. There are no exclusions in the Texas College Savings Plan, all tax brackets, income levels, and financial circumstances are welcome to take part in the plan. Some of the college savings plan attributes include:

- Federal Tax-Exempt Growth- All monies earned in the Texas College Savings Plan are exempt from federal income tax for the duration of the account.

Withdraw Funds Tax-Free- Money saved in the Texas College Savings Plan incurs no taxes if used for higher education. - Many Options for Use- A variety of educational institutions accept money from the plan. These facilities include but are not limited to graduate schools, two-year university, four-year university, and vocational schools. Additionally, the funds earned with the Texas College Savings Plan can pay for studies overseas.

- Easy to Choose or Change the Recipient- Because any Texas resident can take part in the plan, parents, grandparents, and others can set up a Texas College Savings Plan with a designated beneficiary. As long as the account is active, the benefactor can reassign the proceeds to whoever they choose.

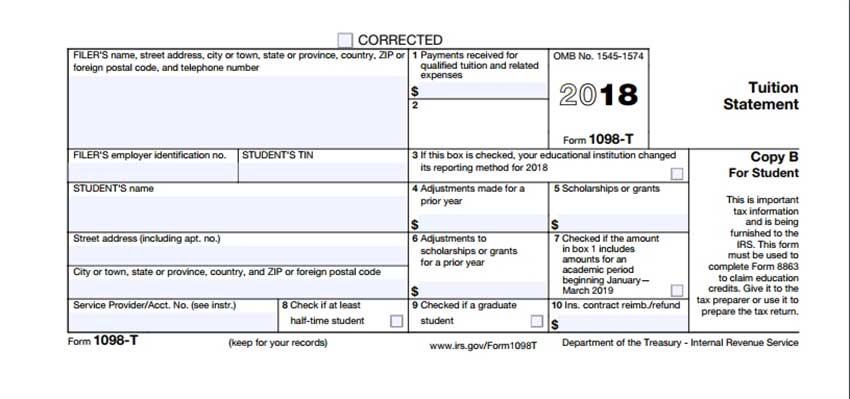

IRS Form 1098-T

The 1098-T form is a tuition statement given to students who attend qualified Texas colleges and universities. Students are required to have been billed by the educational institution for tuition and student fees during the year. Students who demonstrate meeting the necessary requirements can receive an education tax credit on their federal income tax bill.

Texas Tomorrow Fund

This plan is also known as The Texas Tuition Promise Fund and is a way to receive tax reductions by saving for future college tuition tax-free. With the Texas Tomorrow Fund, any legal United States Citizen can begin a fund for the beneficiary of their choice providing the recipient is a resident of the State of Texas. Individuals can contribute up to $14,000 per year and per child; this doubles to $28,000 for married couples. A second option is a one-time gift of up to $70,000 ($140,000 for married couples.) This amount is prorated over a period of five years and will not incur a federal gift tax. Additionally, the Texas Tomorrow Fund is not considered an asset of the student, but of the creator of the account.

With the costs of higher education steadily rising, students in Texas can hold onto their dreams of college because of these helpful programs.

About the author

Thank you, Scott Groza, for gathering all the information. Scott Groza is a highly trained educator who used his training and experience in the educational field to co-found the Groza Learning Center. Mr. Groza identified areas where traditional teaching did not prepare students and created a method to help students thrive.

By

Birgit Sund on

December 3, 2017